Only in America would a company working to cut payments for health care not benefit the patient. The NY Time describes the scam. “The firm, MultiPlan, and the insurance companies it serves often collect larger fees when payments to medical providers are far lower than the amount billed.”

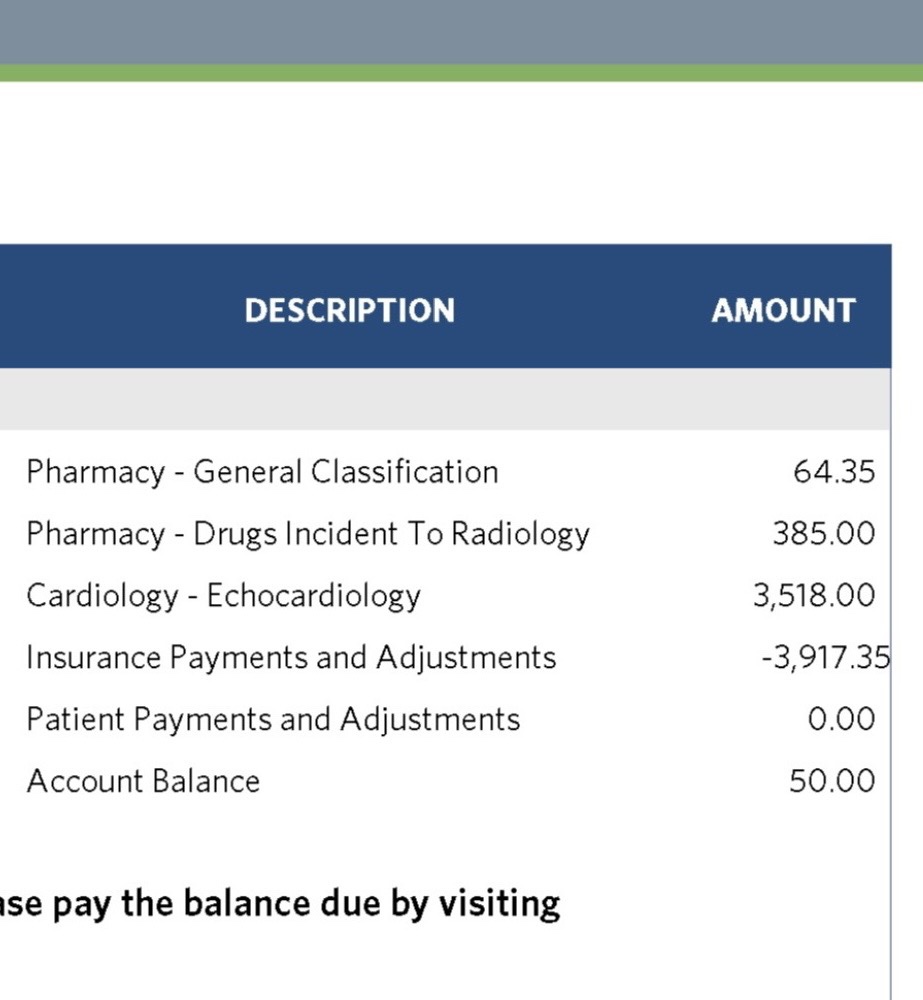

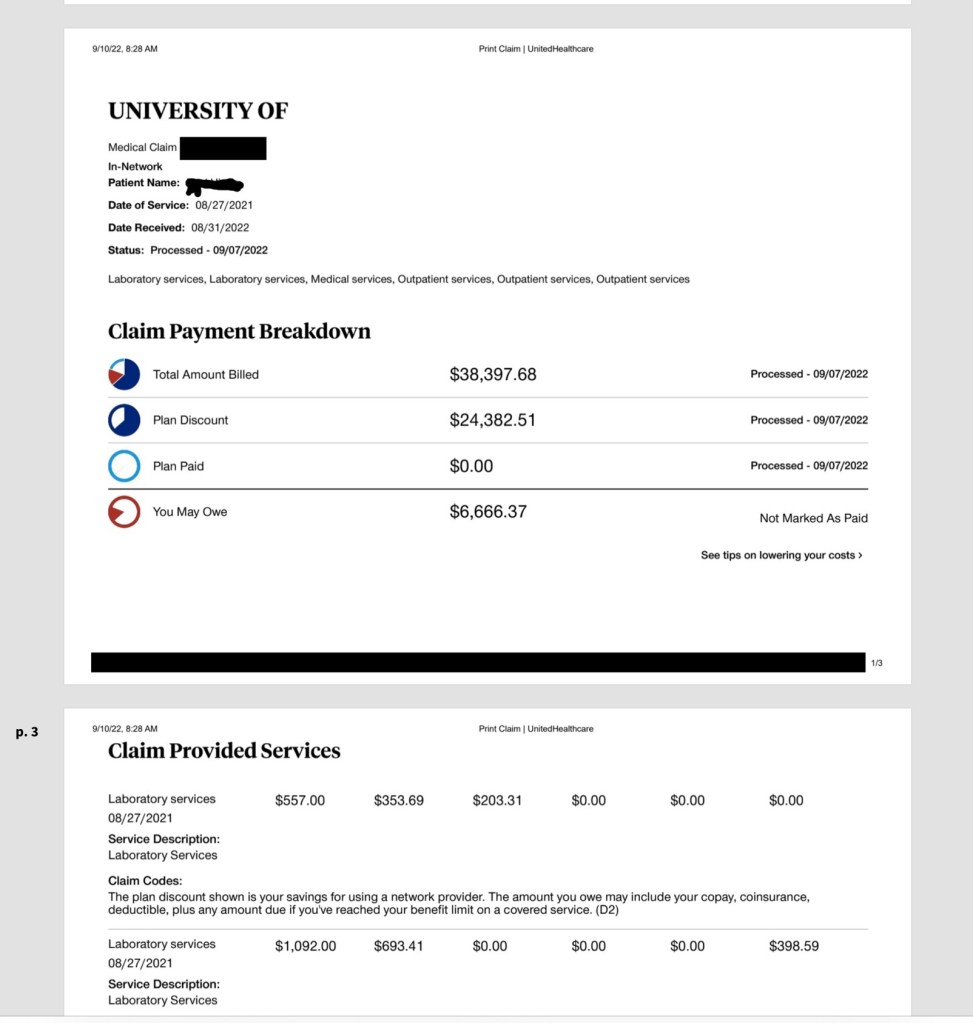

“The Times investigation found that MultiPlan had encouraged some insurers to use its most aggressive pricing tools, leaving medical providers with slashed compensation and employers with high fees — in some instances higher than the medical care payment itself. And left some “patients with unexpectedly high bills as they were asked to pick up what their plans did not cover.”

Medicynical Note: Everyone wins…… except the patient.

The health insurer pays less for care and makes more money. Multiplan makes money because it gets a fee and piece of the “savings.” Providers including hospitals and their health care groups, lest you worry about them, have their own ways of increasing billings and get paid one way or another. Check out the salaries of health care company CEO’s and execs if you doubt me. And guess who gets pay for it all.

These scams are a little like the shell game. The money keeps moving and the last concern is value, access, and affordability of health care. As a result of games like these and there are many, we spend more for healthcare than anywhere else by a wide margin. We are the only place in the world where people go bankrupt from health care costs.

America doesn’t have a healthcare system. Instead it has a sophisticated revenue generating system that does healthcare. In In it, income generation takes precedence over patient outcomes.